Intelligent Fin-Tech Platform

Intelligent Fin-Tech Platform

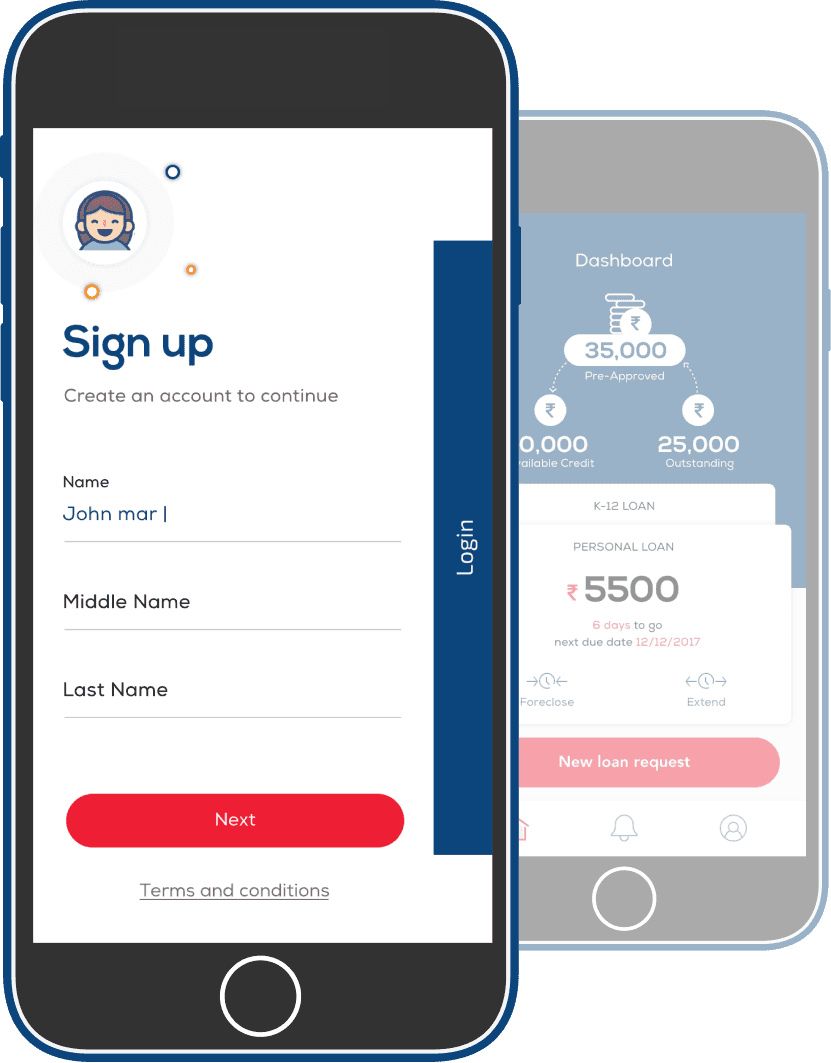

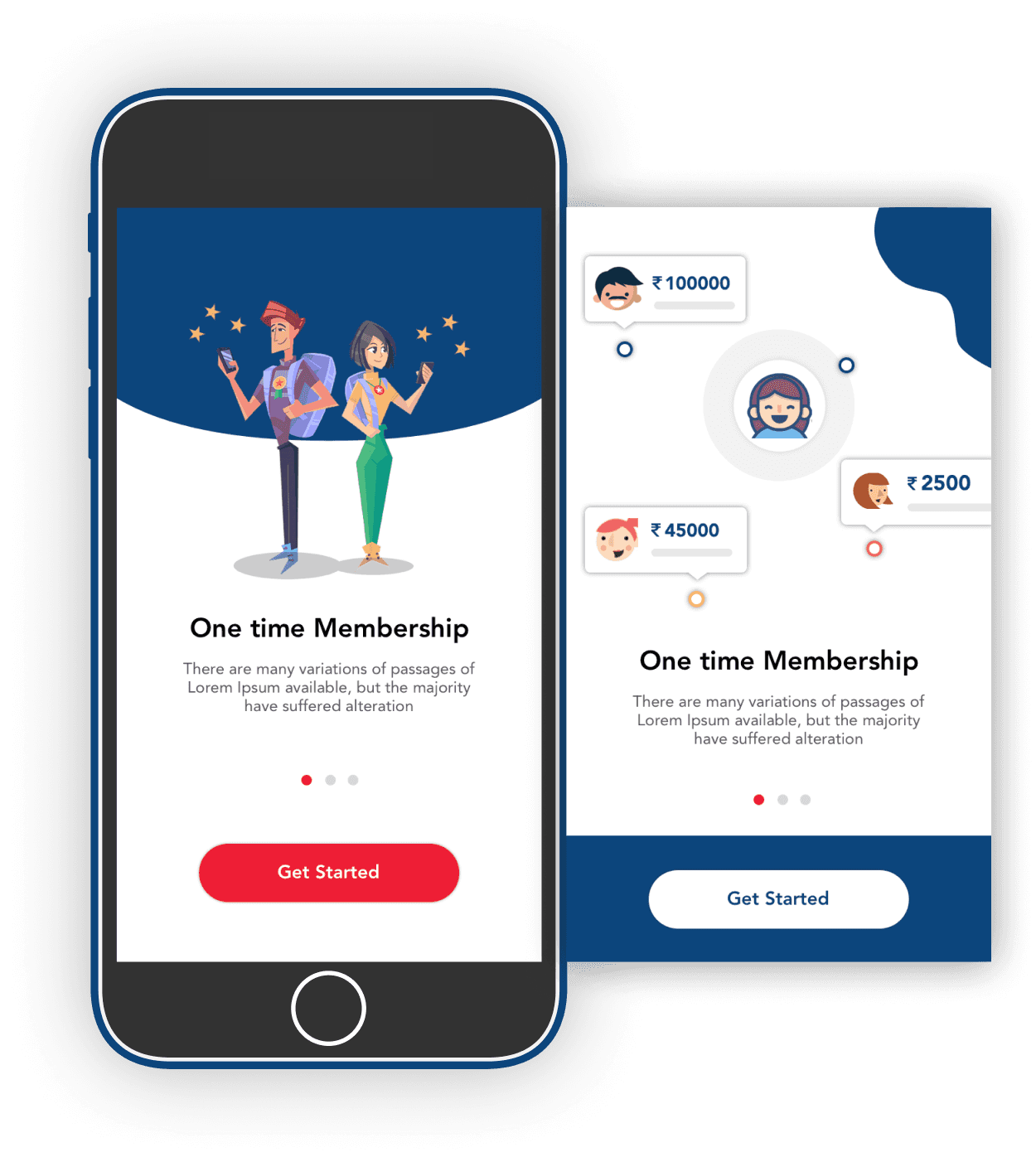

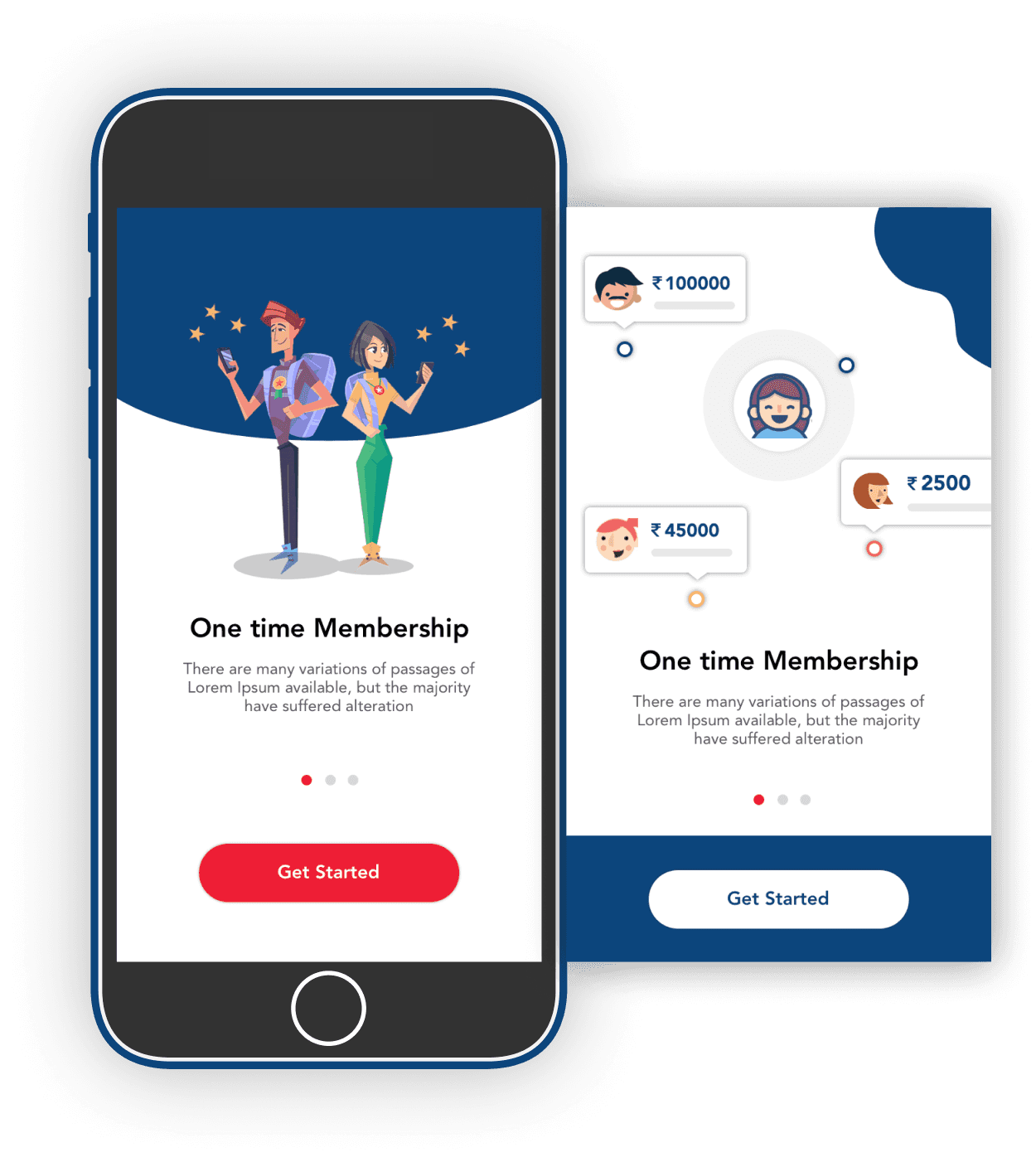

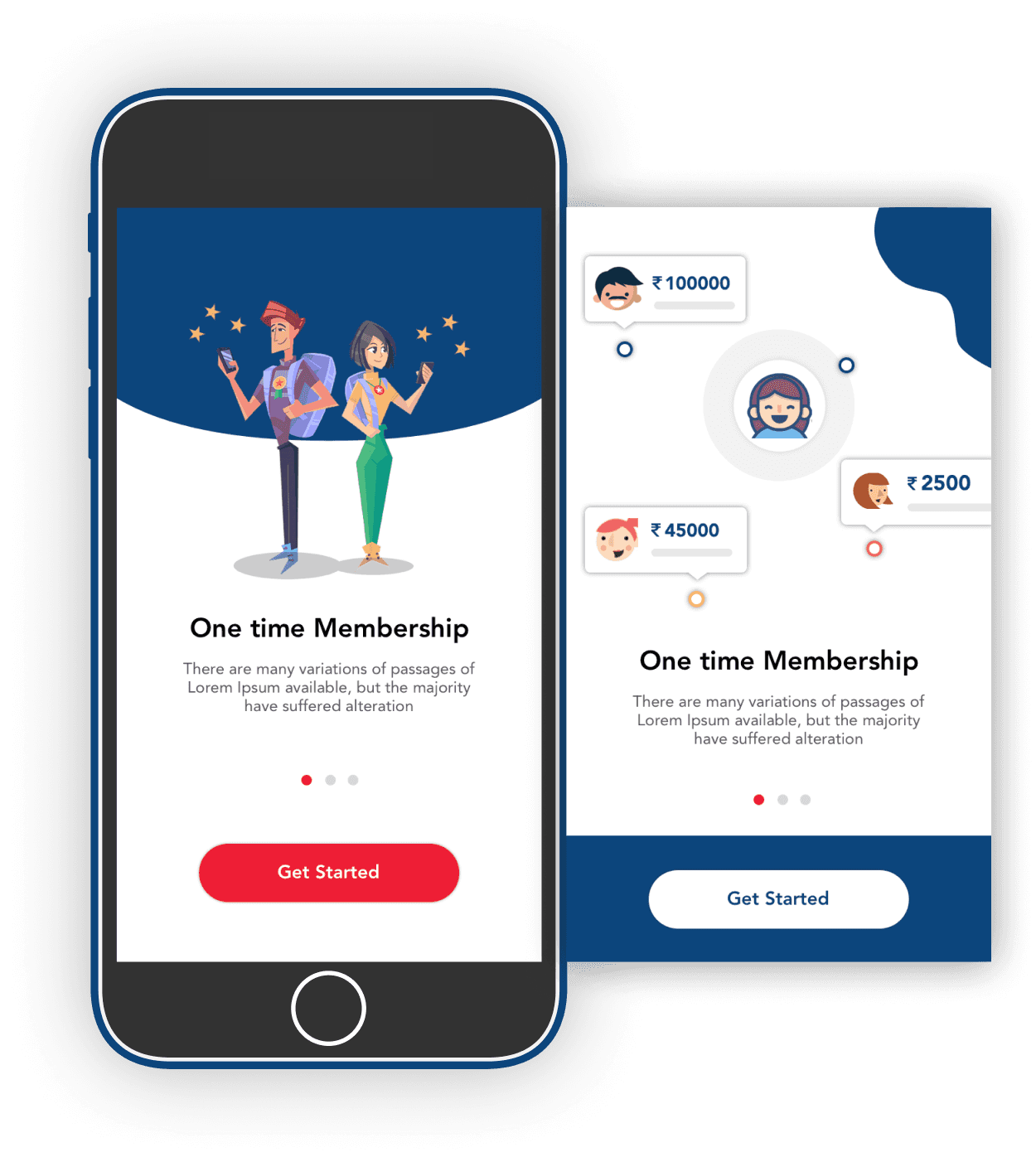

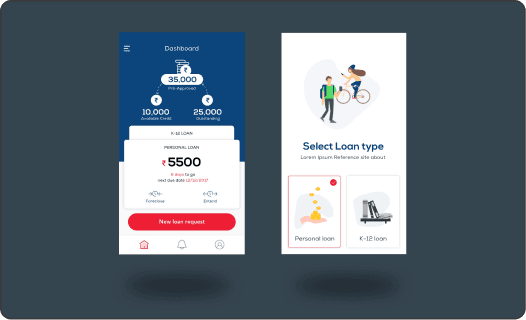

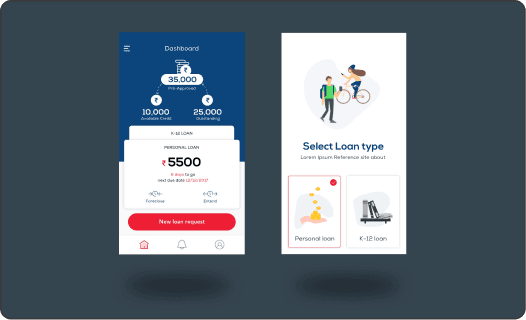

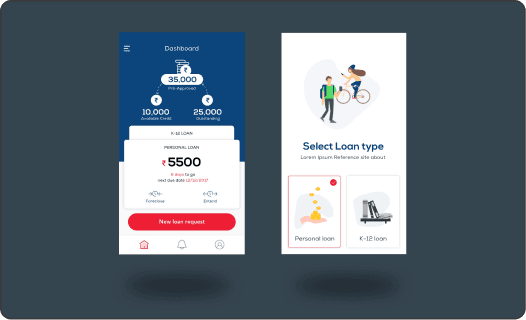

A thriving start-up required a high-speed, efficient, and secure FinTech platform to onboard lenders and enable Peer-to-Peer lending. They partnered with InovarTech to develop a robust solution that aligned IT with the business and focused on technical diversity, business continuity, and maximizing ROI.

A thriving start-up required a high-speed, efficient, and secure FinTech platform to onboard lenders and enable Peer-to-Peer lending. They partnered with InovarTech to develop a robust solution that aligned IT with the business and focused on technical diversity, business continuity, and maximizing ROI.

A thriving start-up required a high-speed, efficient, and secure FinTech platform to onboard lenders and enable Peer-to-Peer lending. They partnered with InovarTech to develop a robust solution that aligned IT with the business and focused on technical diversity, business continuity, and maximizing ROI.

A thriving start-up required a high-speed, efficient, and secure FinTech platform to onboard lenders and enable Peer-to-Peer lending. They partnered with InovarTech to develop a robust solution that aligned IT with the business and focused on technical diversity, business continuity, and maximizing ROI.

A thriving start-up required a high-speed, efficient, and secure FinTech platform to onboard lenders and enable Peer-to-Peer lending. They partnered with InovarTech to develop a robust solution that aligned IT with the business and focused on technical diversity, business continuity, and maximizing ROI.

Cloud Native

Cloud Native

Artificial Intelligence

Artificial Intelligence

Office 365

Office 365

Kubernetes

Kubernetes

The Challenge

The Challenge

The Challenge

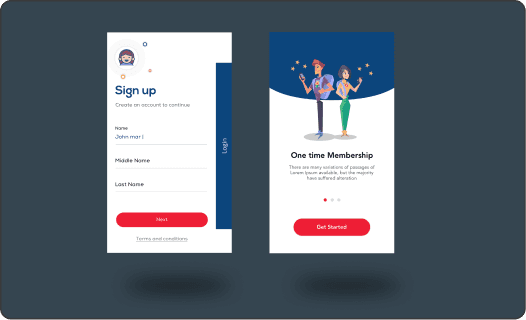

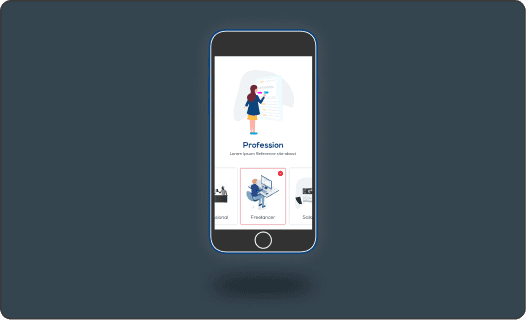

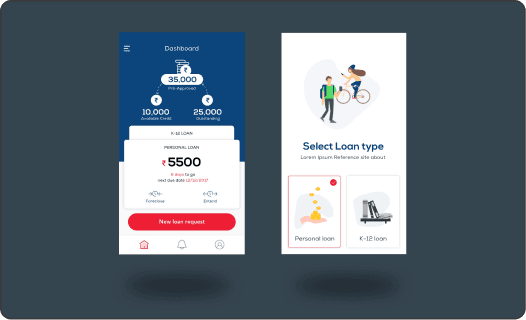

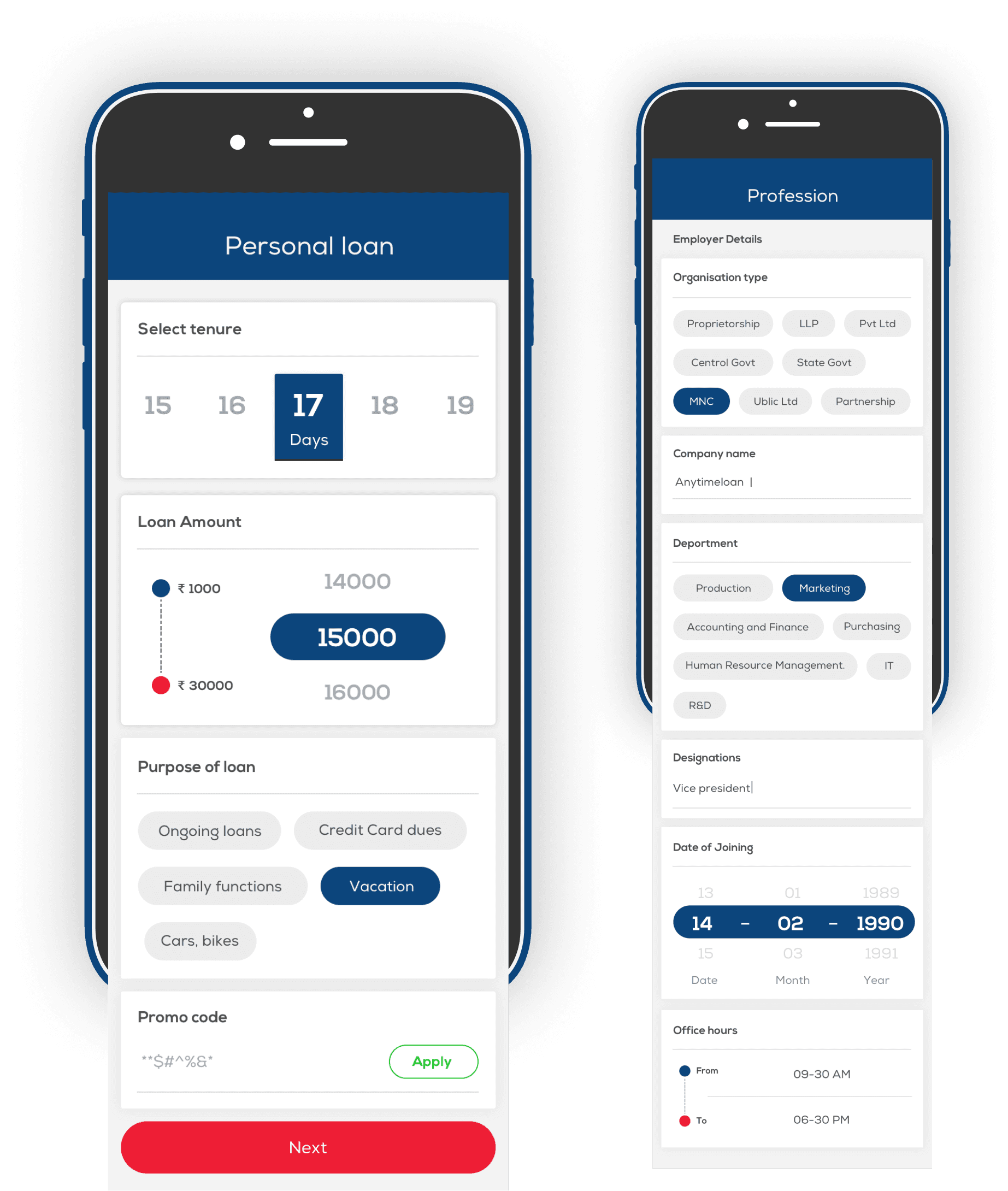

Client stipulations for addressing specific concerns included- a platform to reduce the time taken for registration by five minutes or less and automatically validate documentation with authorities. An AI-powered system to perform facial feature tracking and rate loaner profiles based on the information captured by the system. A rule-based engine to pick the right investors based on risk appetite and provide the desired amount within 30 minutes. An Escrow-based account transfer mechanism to provide security and identity cover for investors and borrowers. A 99.99% uptime with a strong BC/DR plan to ensure smooth operations 24/7 without any personnel support.

Client stipulations for addressing specific concerns included- a platform to reduce the time taken for registration by five minutes or less and automatically validate documentation with authorities. An AI-powered system to perform facial feature tracking and rate loaner profiles based on the information captured by the system. A rule-based engine to pick the right investors based on risk appetite and provide the desired amount within 30 minutes. An Escrow-based account transfer mechanism to provide security and identity cover for investors and borrowers. A 99.99% uptime with a strong BC/DR plan to ensure smooth operations 24/7 without any personnel support.

Client stipulations for addressing specific concerns included- a platform to reduce the time taken for registration by five minutes or less and automatically validate documentation with authorities. An AI-powered system to perform facial feature tracking and rate loaner profiles based on the information captured by the system. A rule-based engine to pick the right investors based on risk appetite and provide the desired amount within 30 minutes. An Escrow-based account transfer mechanism to provide security and identity cover for investors and borrowers. A 99.99% uptime with a strong BC/DR plan to ensure smooth operations 24/7 without any personnel support.

The Solution

The Solution

The Solution

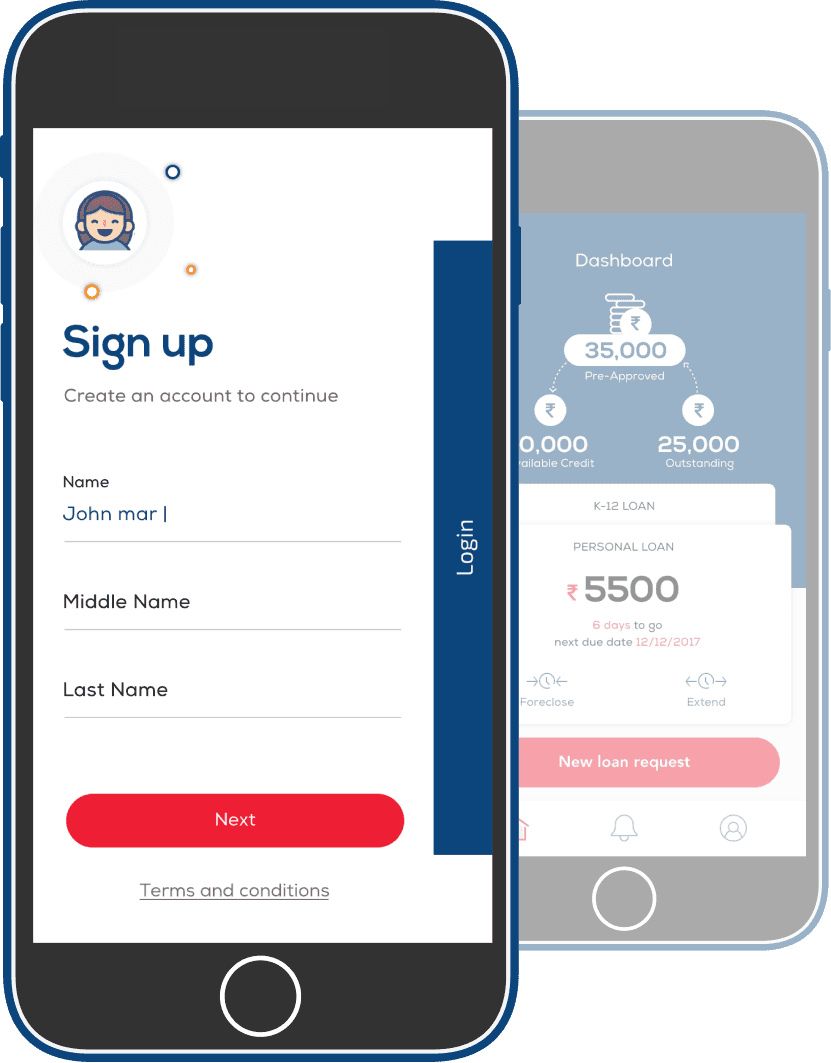

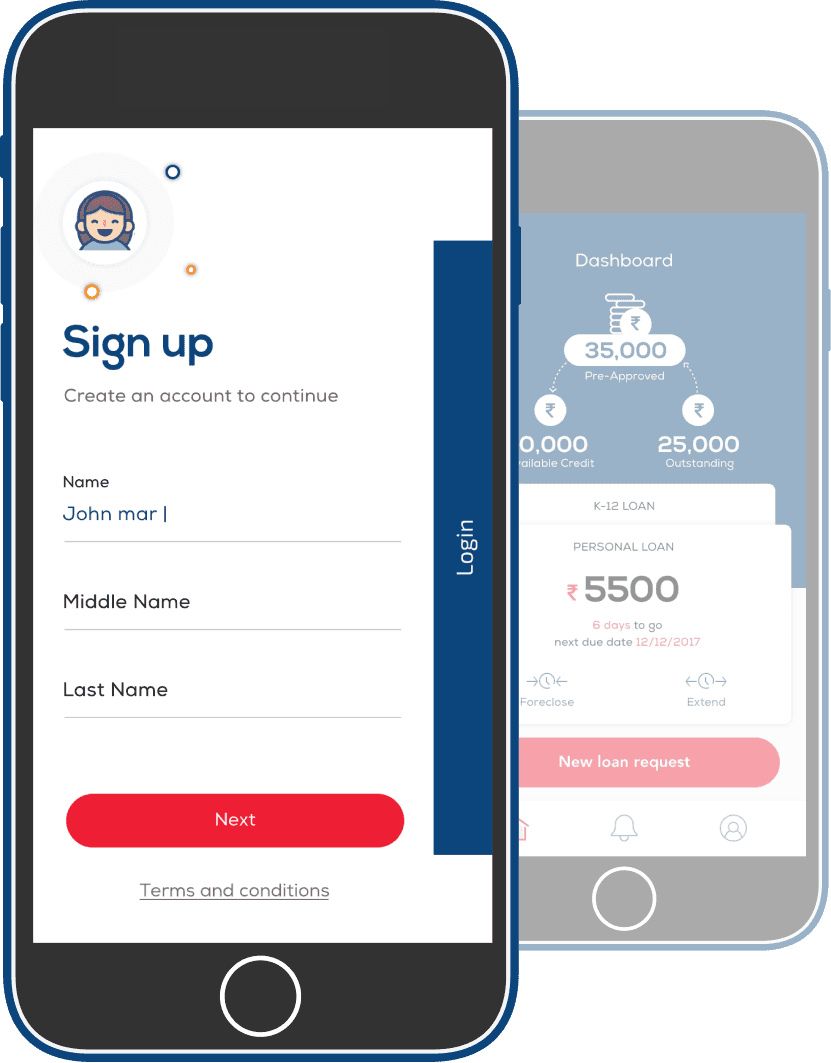

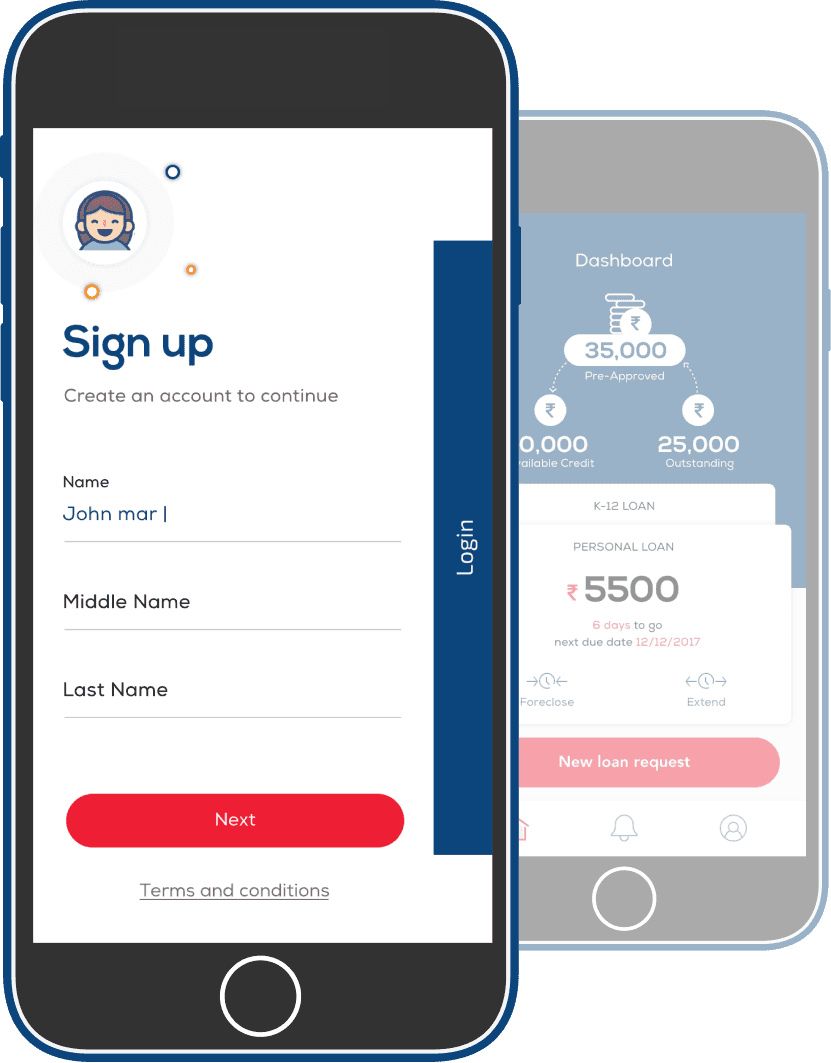

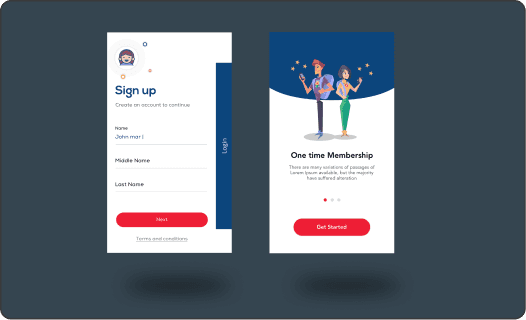

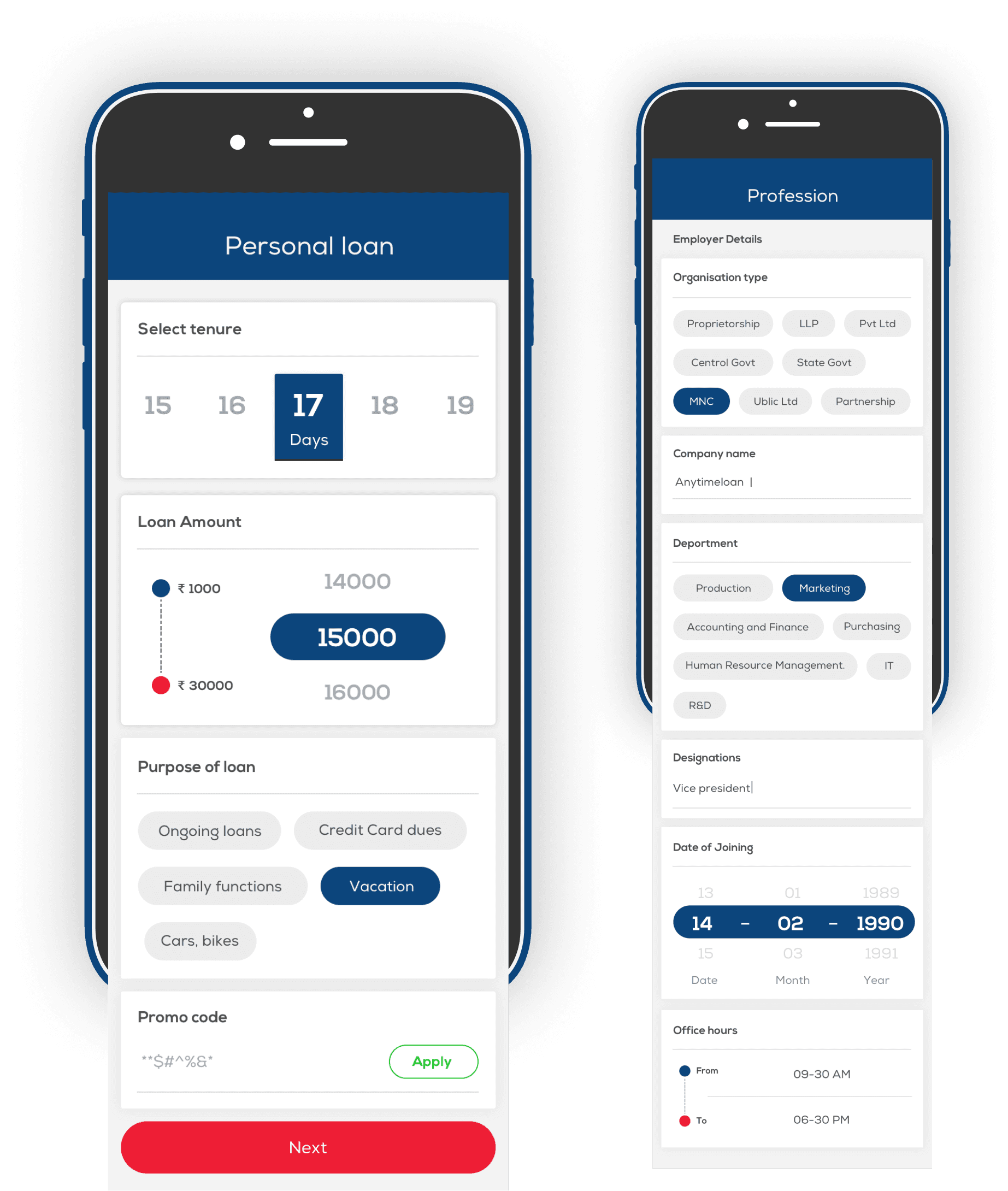

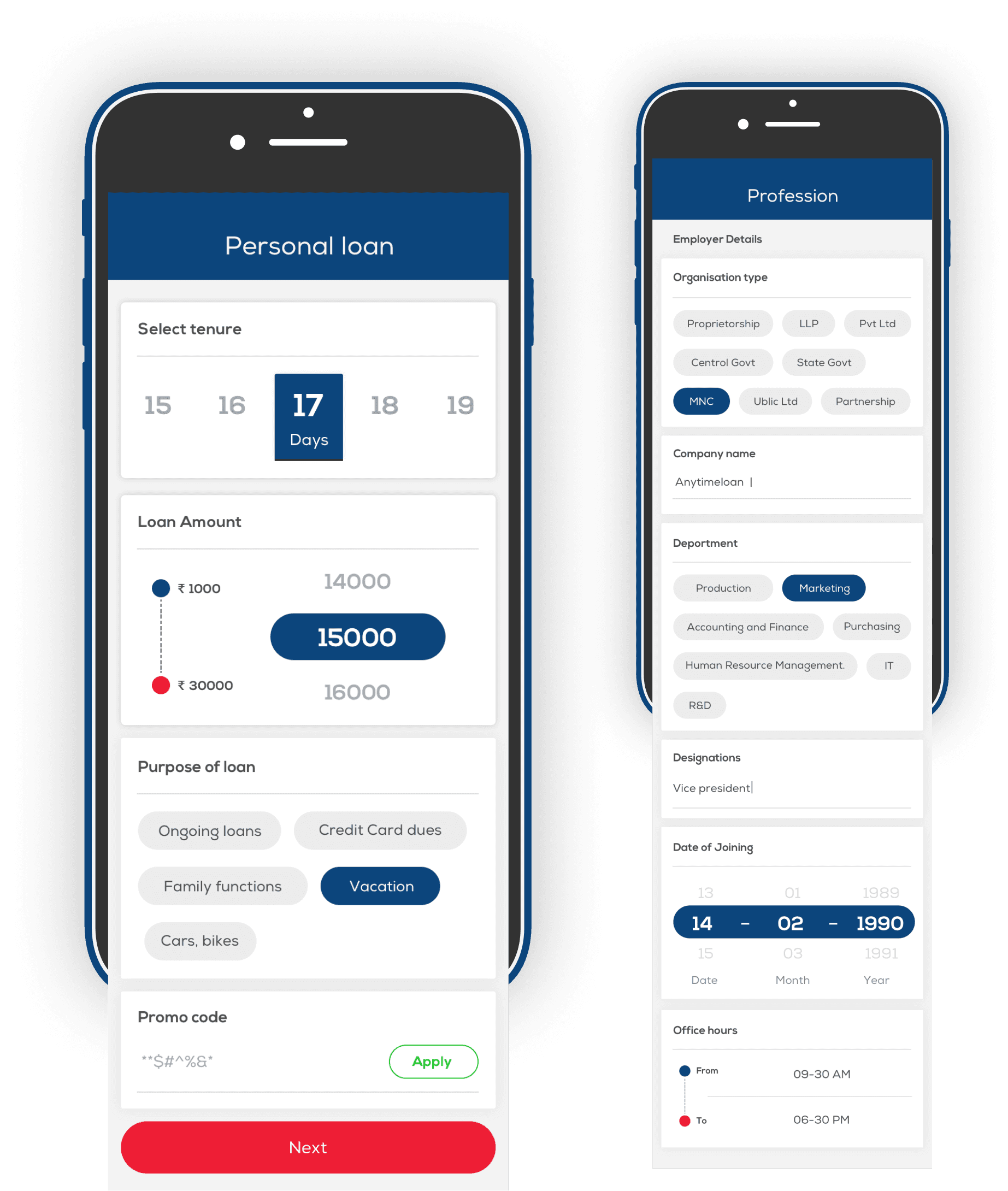

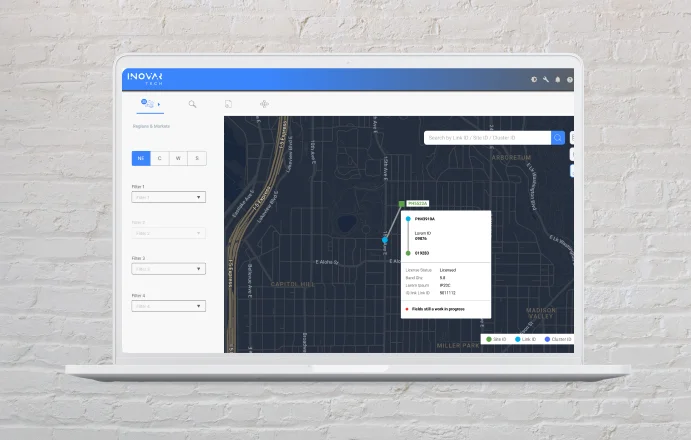

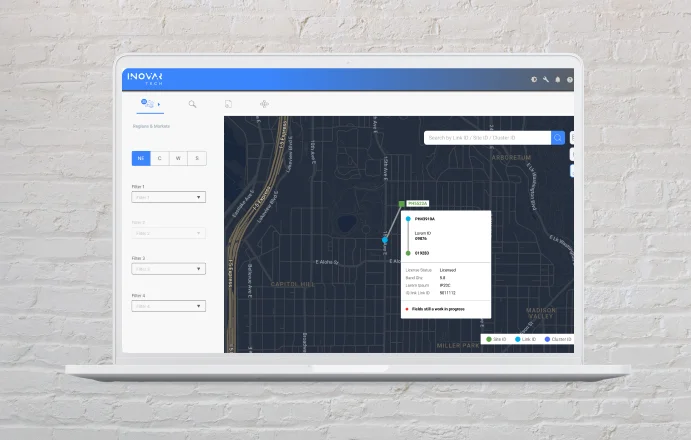

InovarTech's expert team had to rise to the occasion and determine AI models to drive the system and the implementation process for a massive enterprise architecture. After extensive research with target users, InovarTech helped the company refine the user experience and interface before building and launching the digital lending platform. To provide agility and scalability, we utilized microservices in serverless architecture with micro front ends and Office 365 consulting services like Dynamics for CRM as the architecture. We handled integrations via an API gateway to ensure compatibility with a dozen third-party systems, which were all built with their technology.

InovarTech's expert team had to rise to the occasion and determine AI models to drive the system and the implementation process for a massive enterprise architecture. After extensive research with target users, InovarTech helped the company refine the user experience and interface before building and launching the digital lending platform. To provide agility and scalability, we utilized microservices in serverless architecture with micro front ends and Office 365 consulting services like Dynamics for CRM as the architecture. We handled integrations via an API gateway to ensure compatibility with a dozen third-party systems, which were all built with their technology.

InovarTech's expert team had to rise to the occasion and determine AI models to drive the system and the implementation process for a massive enterprise architecture. After extensive research with target users, InovarTech helped the company refine the user experience and interface before building and launching the digital lending platform. To provide agility and scalability, we utilized microservices in serverless architecture with micro front ends and Office 365 consulting services like Dynamics for CRM as the architecture. We handled integrations via an API gateway to ensure compatibility with a dozen third-party systems, which were all built with their technology.

Intelligent Insight and Automation

Intelligent Insight and Automation

Intelligent Insight and Automation

Intelligent Insight and Automation

We proposed a complete open-source stack that boosted performance, improved design, and implemented Cloud Native Development Services like Kubernetes, Secure API management, messaging queues, and managed databases in the cloud. InovarTech's robust disaster recovery and failover system supported their need to be available 99.999% of the time. It built trust among users who were required to supply sensitive financial information to the platform. InovarTech's design support was crucial in facilitating the adoption of a user-centric perspective by the client's long-term partner.

We proposed a complete open-source stack that boosted performance, improved design, and implemented Cloud Native Development Services like Kubernetes, Secure API management, messaging queues, and managed databases in the cloud. InovarTech's robust disaster recovery and failover system supported their need to be available 99.999% of the time. It built trust among users who were required to supply sensitive financial information to the platform. InovarTech's design support was crucial in facilitating the adoption of a user-centric perspective by the client's long-term partner.

We proposed a complete open-source stack that boosted performance, improved design, and implemented Cloud Native Development Services like Kubernetes, Secure API management, messaging queues, and managed databases in the cloud. InovarTech's robust disaster recovery and failover system supported their need to be available 99.999% of the time. It built trust among users who were required to supply sensitive financial information to the platform. InovarTech's design support was crucial in facilitating the adoption of a user-centric perspective by the client's long-term partner.

We proposed a complete open-source stack that boosted performance, improved design, and implemented Cloud Native Development Services like Kubernetes, Secure API management, messaging queues, and managed databases in the cloud. InovarTech's robust disaster recovery and failover system supported their need to be available 99.999% of the time. It built trust among users who were required to supply sensitive financial information to the platform. InovarTech's design support was crucial in facilitating the adoption of a user-centric perspective by the client's long-term partner.

Benefits

Benefits

Benefits

The innovative AI-powered Fintech software effectively catered to both users and developers. The robust and unique platform harnessed AI capabilities and helped validate risk levels, manage 10000+ users in the first year, and manage loans up to a quarter million dollars. It also ensured Zero security breaches and downtime.

The innovative AI-powered Fintech software effectively catered to both users and developers. The robust and unique platform harnessed AI capabilities and helped validate risk levels, manage 10000+ users in the first year, and manage loans up to a quarter million dollars. It also ensured Zero security breaches and downtime.

The innovative AI-powered Fintech software effectively catered to both users and developers. The robust and unique platform harnessed AI capabilities and helped validate risk levels, manage 10000+ users in the first year, and manage loans up to a quarter million dollars. It also ensured Zero security breaches and downtime.

More Case Studies

Intelligent Process Automation

Discover how InovarTech's expert End-to-End Strategy Consulting Services helped the world's largest Youth-Serving NGO make the most out of their tech investments.

Youth Serving NGO Gets A Technological Uplift

Intelligent Automation for Healthcare

More Case Studies

Leading PVC Manufacturer Eliminates Cracks and Boosts Quality with VisionGuard.AI

InovarTech's AI-Powered Vision System Automates Defect Detection, Reduces Customer Rejections by 95%, and Optimizes Production for a Top 5 Plastics Manufacturer in India

Leading Cooking Oil Manufacturer in Saudi Arabia Enhances Food Safety with AI-Powered Visual Inspection

Global baby and adult care Multi-national achieves Product Excellence with AI-Powered Quality Control

More Case Studies

Intelligent Process Automation

Discover how InovarTech's expert End-to-End Strategy Consulting Services helped the world's largest Youth-Serving NGO make the most out of their tech investments.

Youth Serving NGO Gets A Technological Uplift

Intelligent Automation for Healthcare

More Case Studies

Intelligent Process Automation

Youth Serving NGO Gets A Technological Uplift

Intelligent Automation for Healthcare

More Case Studies

Intelligent Process Automation

Youth Serving NGO Gets A Technological Uplift

Intelligent Automation for Healthcare

More Case Studies

Intelligent Process Automation

Youth Serving NGO Gets A Technological Uplift

Intelligent Automation for Healthcare

More Case Studies

Intelligent Process Automation

Youth Serving NGO Gets A Technological Uplift

Intelligent Automation for Healthcare

Explore more topics

Ready to brush up on something new? We've got more to read right this way.

Explore more topics

Ready to brush up on something new? We've got more to read right this way.

Explore more topics

Ready to brush up on something new? We've got more to read right this way.

Explore more topics

Ready to brush up on something new? We've got more to read right this way.

Explore more topics

Ready to brush up on something new? We've got more to read right this way.

TECH

Inspire

Ideate

Inovate

Reach Out to Us :

Copyright © 2025 InovarTech. All rights reserved

TECH

Inspire

Ideate

Inovate

Reach Out to Us :

Copyright © 2025 InovarTech. All rights reserved

TECH

Inspire

Ideate

Inovate

Reach Out to Us :

Copyright © 2025 InovarTech. All rights reserved

TECH

Inspire

Ideate

Inovate

Reach Out to Us :

Copyright © 2025 InovarTech. All rights reserved

TECH

Inspire

Ideate

Inovate

Reach Out to Us :

Copyright © 2025 InovarTech. All rights reserved